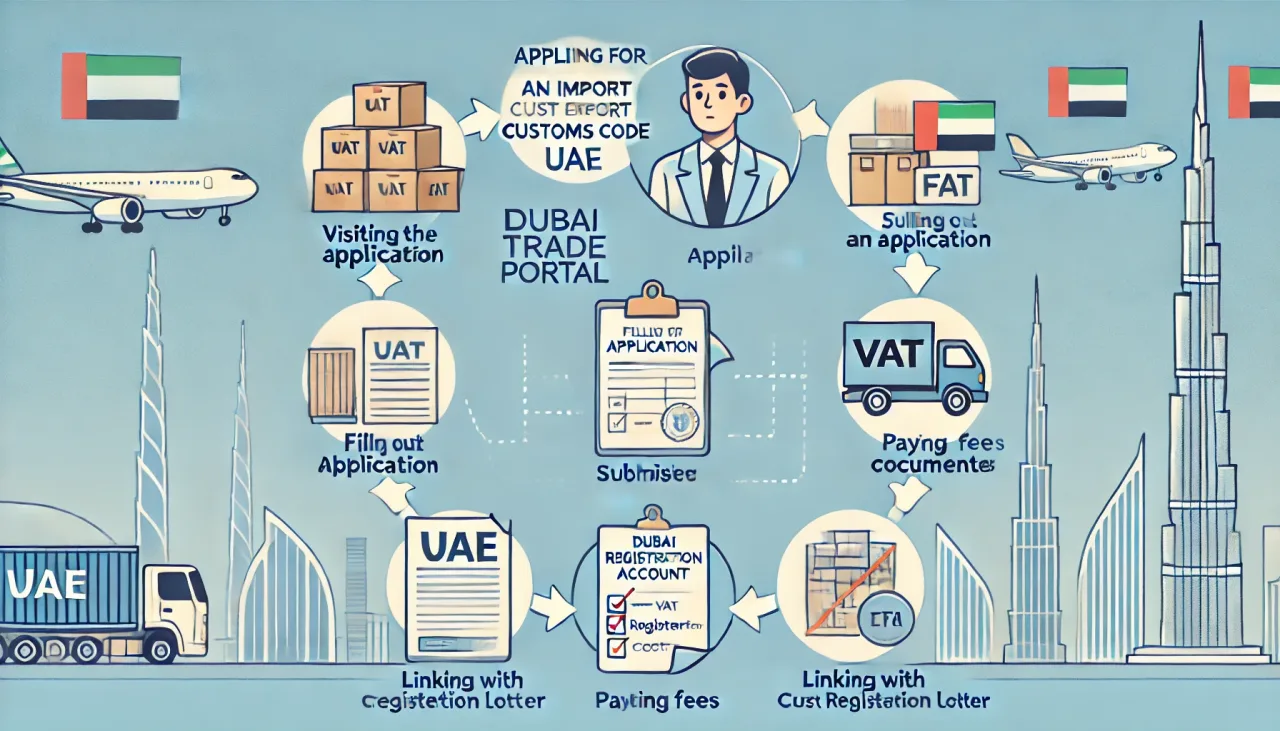

The UAE is a major global hub for trade and commerce, making it essential for businesses involved in importing and exporting to have a valid customs code. This guide will walk you through the process of obtaining an import export customs code in the UAE via the Dubai Trade Portal and highlight the importance of requesting additional certificates and a VAT Registration Letter to ensure seamless operations.

Step 1: Understanding the Import Export Customs Code

An Import Export Customs Code, also known as a Customs Client Code or Importer Exporter Code, is a unique identification number issued to trading businesses and individuals involved in import and export activities. This code is mandatory for customs clearance and other related procedures.

Step 2: Registering with the UAE Customs via Dubai Trade Portal

To apply for the import export customs code, you must register with the UAE Customs through the Dubai Trade Portal. Here’s how:

- Visit the Dubai Trade Portal: Go to the Dubai Trade Portal.

- Start the Registration: Click on the registration link to begin the application process.

- Fill Out the Application: Complete the customs registration form by providing all necessary details about your business, including trade license information, contact details, and the nature of your business activities.

- Submit the Application: Once the form is filled out, submit it along with required documents.

Step 3: Submitting Required Documents

When applying for the customs code, you will need to submit the following documents:

- Valid trade license

- Emirates ID, passport copy, visa, labor card of the business owner or its representative

- Proof of VAT registration (if applicable)

- Any other documents requested by the customs authority

Step 4: Payment of Fees

After submitting your application, it will go for approval. Once approved, you will receive an approval email with a payment link. You can then pay the total fee of AED 125. AED 225 if the VAT Registration Letter have been requested.

Step 5: Requesting Certificates and VAT Registration Letter

It is crucial to request additional VAT Registration Letter during the registration process. This document are necessary to link your company with the Federal Tax Authority (FTA) account and avoid delays in customs clearance which costs an additional AED 100. T

Step 6: Linking Your Company with the FTA Account

To ensure a smooth customs clearance process, you must link your company with the FTA account. This can be done by:

- Logging into the FTA Portal: Access the FTA portal using your credentials.

- Updating Your Information: Update your company information and upload the VAT Registration Letter and any other necessary details.

- Confirming the Link: Ensure that your amendment is successfully approved.

Step 7: Receiving Your Import Export Customs Code

Once your application payment is processed, you will receive your unique customs code. This code must be used for all import and export transactions to comply with UAE customs regulations.

Conclusion

Obtaining an import export customs code is a vital step for any business involved in trade in the UAE. By following the steps outlined in this guide and ensuring you request additional certificates and a VAT Registration Letter, you can avoid delays and ensure smooth customs clearance for your goods.

If you need assistance with the registration process or any other corporate services, please contact us at Integrity Corporate Services FZ LLC. Our team of experts is here to help you navigate the complexities of UAE customs regulations and ensure your business operates smoothly.